How to Generate Financial Statements in Excel: 3 Methods

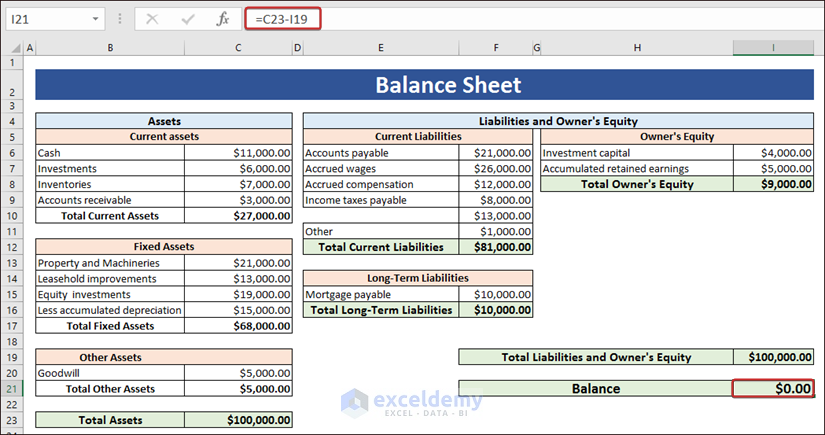

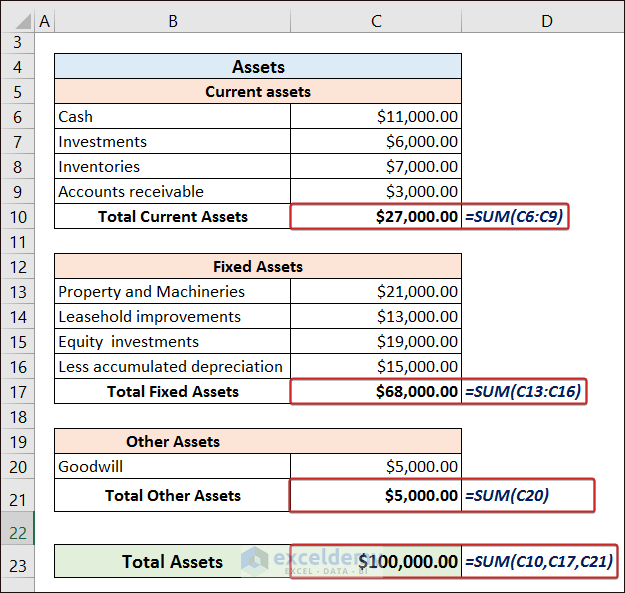

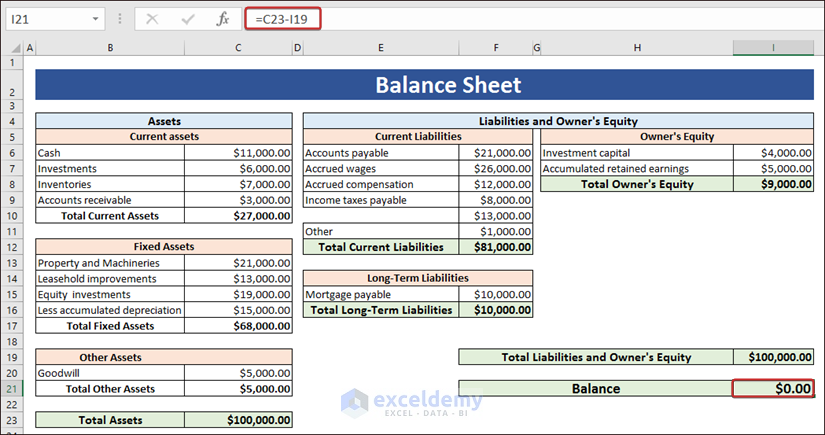

To create a Balance Sheet, we need to calculate the net balance. The following formula calculates the Net Balance.

Balance = Assets – Total Liabilities – Owner’s Equity

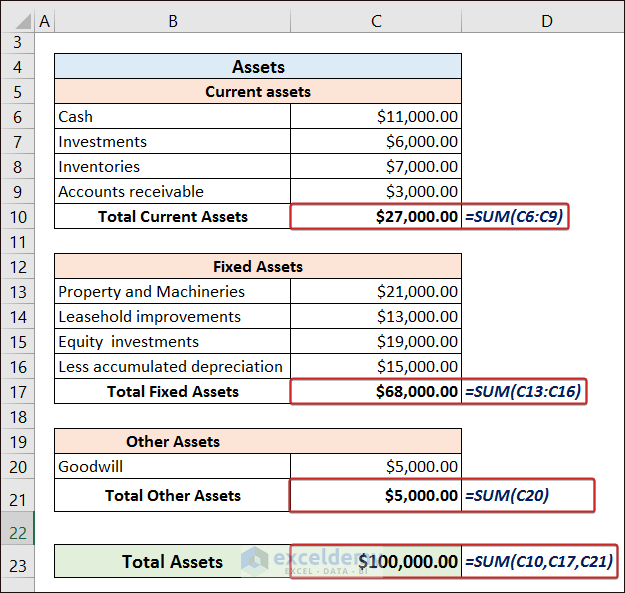

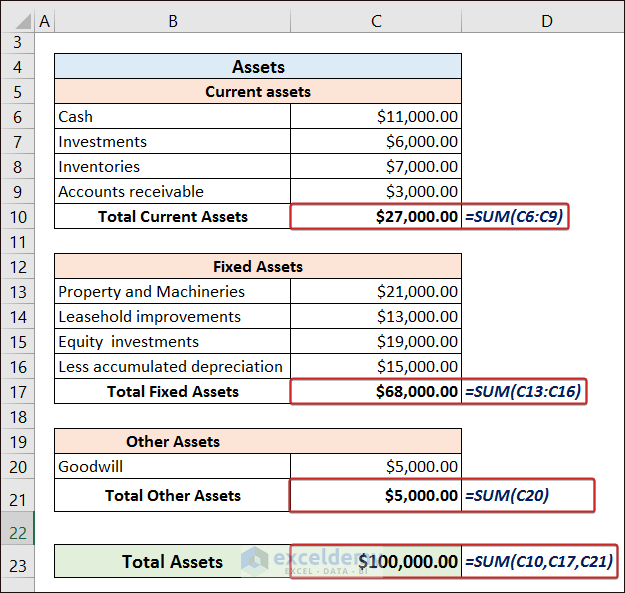

Assets Calculation

- Use the SUM function to calculate the Total Current Assets, Total Fixed Assets, and Total Other Assets.

- Calculate the Total Assets by adding them up.

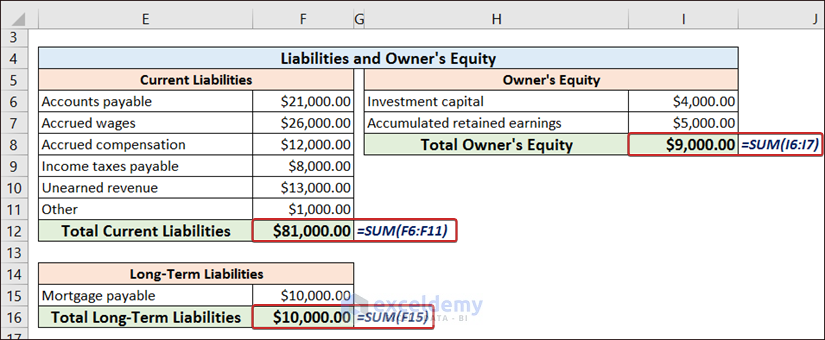

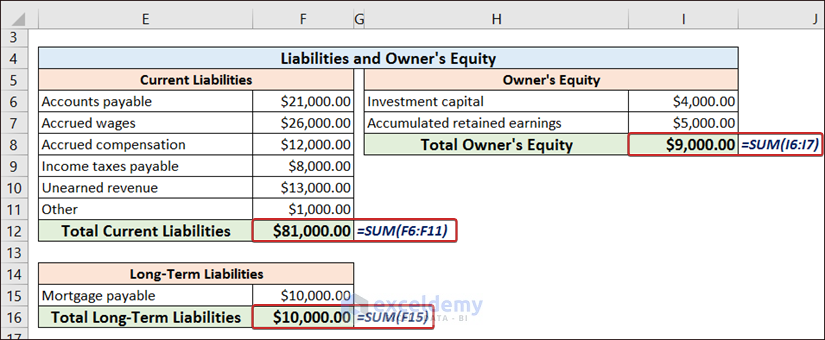

Liabilities and Owner’s Equity Calculation

- Insert the values of current and long-term liabilities to calculate their total.

- Calculate the Total Owner’s Equity.

Click here to enlarge the image.

Calculate Balance Amount

- Calculate the Total Liabilities and Owner’s Equity and subtract them from the Total Assets to have the net balance.

Click here to enlarge the image

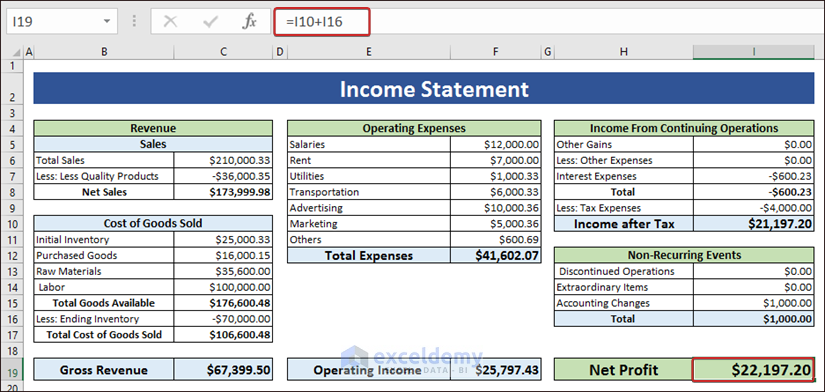

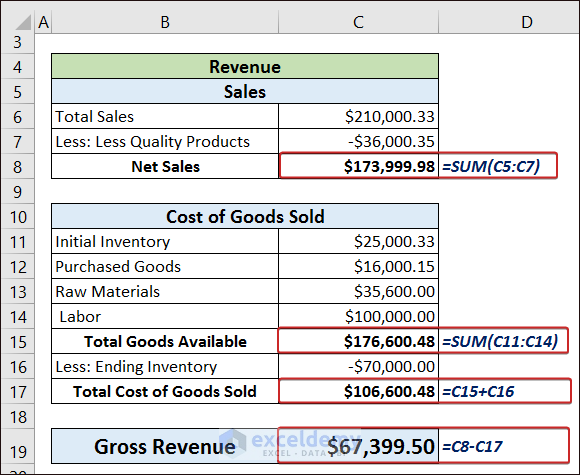

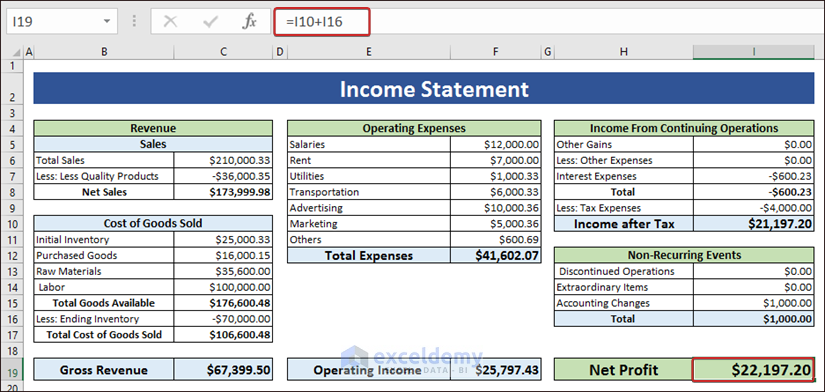

Method 2 – Generating Income Statement Sheet

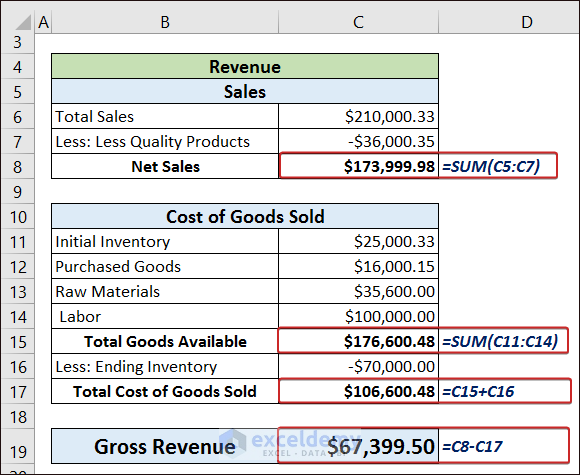

Calculating Total Revenue

- Calculate the gross revenue by subtracting the total cost of goods from the net sales.

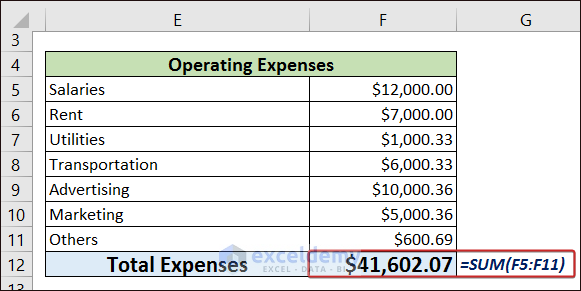

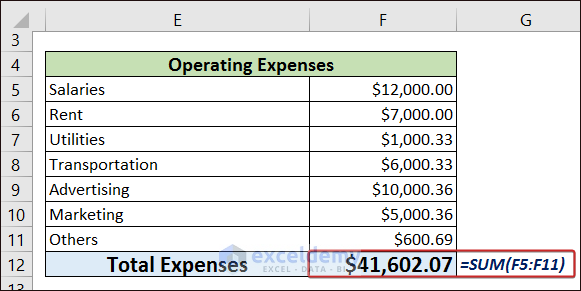

Evaluating Total Operating Expenses

- Add all the relevant operational costs to calculate the Total Operating Expenses.

Calculating Net Profit

- Consider all the additional items, like income from continuing operations and non-recurring events, and use all of them to calculate the net profit.

Click here to enlarge the image.

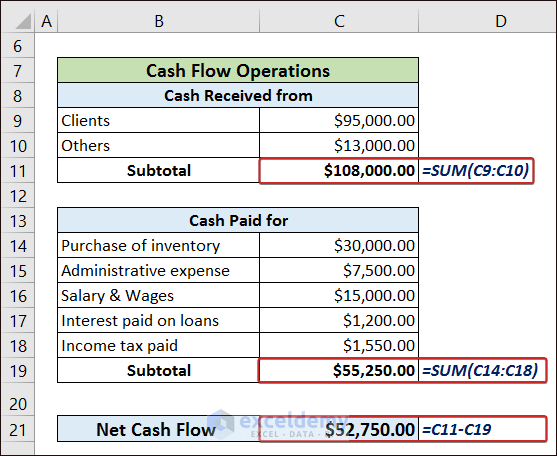

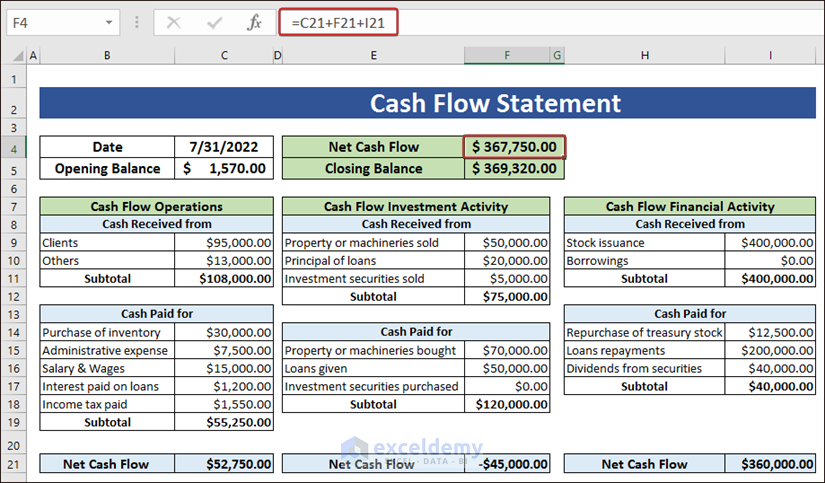

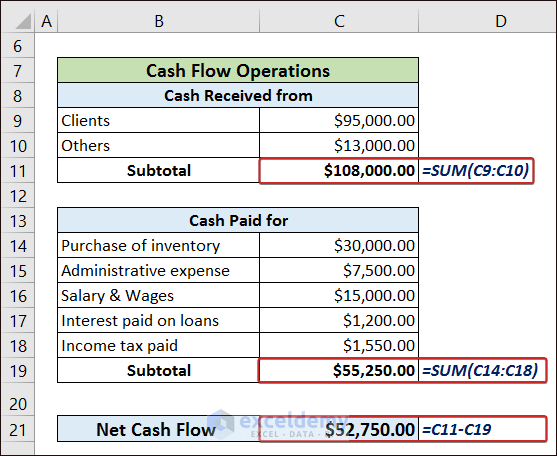

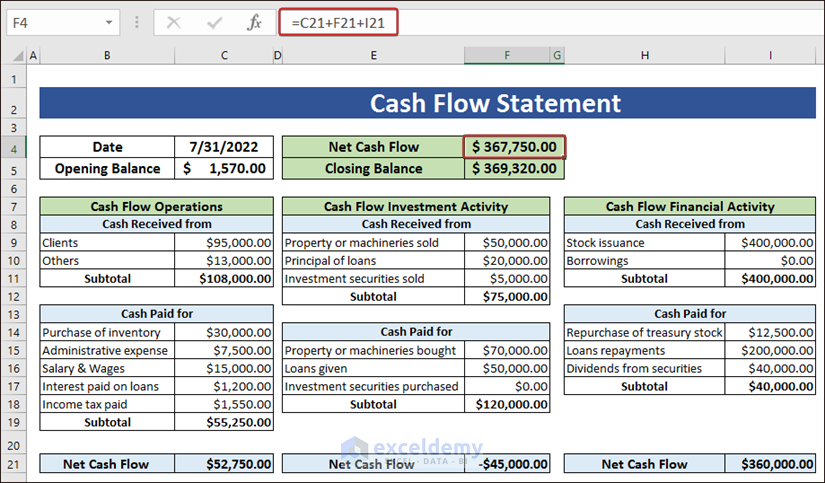

Method 3 – Creating a Cash Flow Statement Sheet

Calculating Net Cash Flow of Operations

- Calculate the net cash flow of operations by considering cash received from clients or many other sources and cash paid for reasons like inventory, salary, administrative expenses, interest, etc.

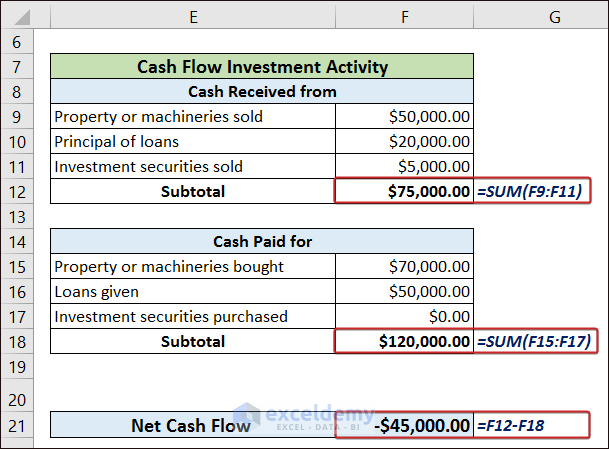

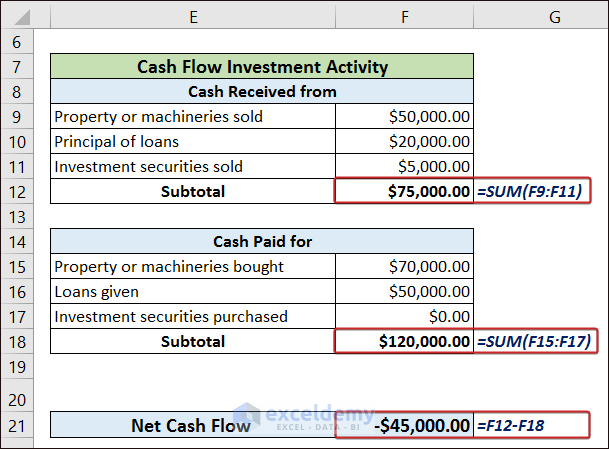

Estimating Net Cash Flow of Investment Activity

- Calculate the net cash flow of investment activity by considering items relevant to the company’s assets, such as properties, machinery, loans, investment securities, etc.

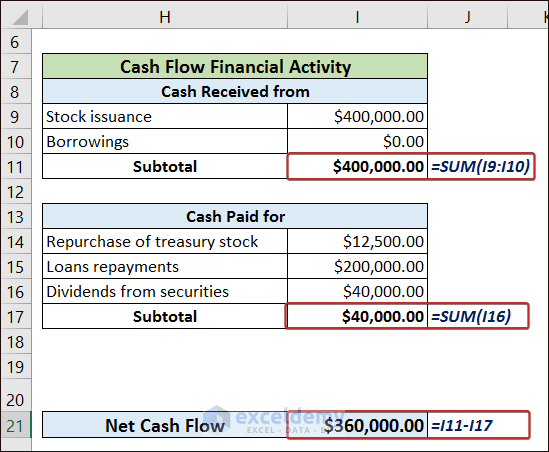

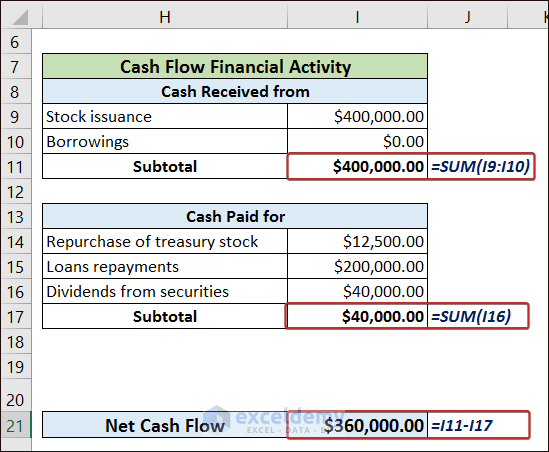

Calculating Net Cash Flow of Financial Activity

- Calculate the net cash flow of financial activity, including items related to the company’s financial matters like stock issuance, borrowings, dividends, etc.

- Add up all the net cash flows to have the total net cash flow.

Click here to enlarge the image

What Things Should You Remember?

- Format the data correctly and maintain consistency and clarity.

- Carefully review all the formulas before finalizing the financial statement.

- Add meaningful labels and headings so the statements look descriptive to the user. It also makes them easier to understand for future uses.

Frequently Asked Questions

1. What are the 5 financial statements?

There are five basic types of financial statements in business: balance sheet, income statement, cash flow statement, statement of changes in capital, and notes to financial statements.

2. Does Excel have a financial statement template?

Yes, there are many built-in financial statement templates in Excel. Search for the template from the File tab and pick the one you desire.

3. What is the formula for net income?

The formula we use to calculate the net income is:

Net Income = Total Revenues – Total Expenses

How to Create Financial Statements in Excel: Knowledge Hub

- Prepare Financial Statements

- Automate Financial Statements

- Link 3 Financial Statements

- Prepare Financial Statements from Trial Balance

- Create a Personal Financial Statement

- How to Create Pro Forma Financial Statements in Excel

- Consolidation of Financial Statements in Excel