Aloun Khountham is a freelance real estate contributor to The Close. Her real estate experience stems from over five years as a New York City real estate operations executive for a growing brokerage. See full bio

Reviewed by Table of ContentsIf you’re like most agents, diving into the details of your real estate agent commission splits might not be as thrilling as closing a big sale, but getting it right can make all the difference in your paycheck. Whether you’re a seasoned pro or a newcomer hustling to make your mark, understanding how your hard-earned cash is divided between you and your broker is crucial. So, let’s break down the nuts and bolts of real estate commission splits.

Real estate commission is a key real estate term that refers to the fee paid to real estate agents for their services in facilitating the sale or lease of a property. Commissions are typically an agent’s primary source of income and are earned through the sale, purchase, or leasing of properties.

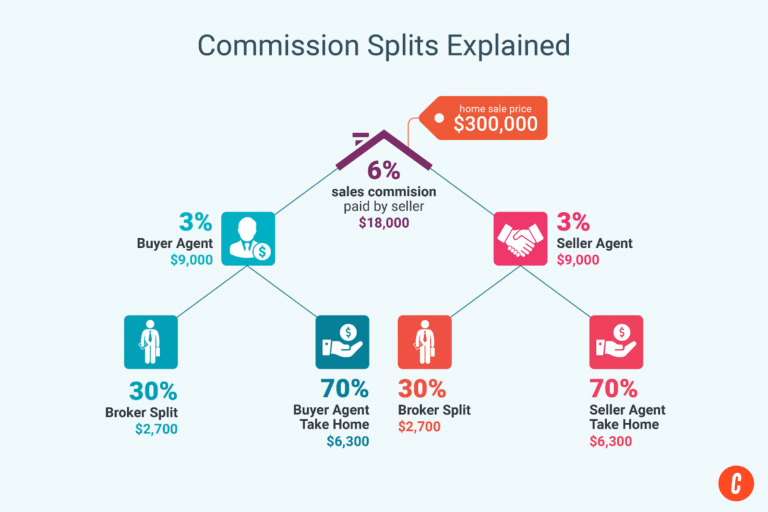

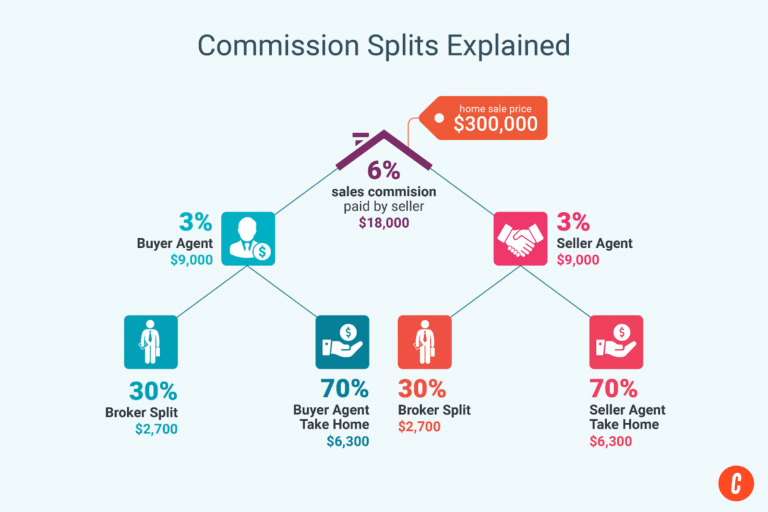

Commission split between agents in the transaction: The total commission is usually a percentage of the sale price or rental fee, agreed upon in the listing agreement between the seller or landlord and the listing broker. This percentage can vary significantly based on location, property type, market conditions, and the type of transaction, usually ranging from 2% to 6% for sales and often one month’s rent for leases. The commission split agreement between agents varies depending on the listing agent’s agreement with the seller.

Example calculation:

Sale price of the home: $500,000 Total commission rate: 6%

Step 1: Calculate the total commission

Total Commission = Sale Price x Commission Rate

Total Commission = $500,000 x 6% = $30,000

Step 2: Divide the commission between the listing and the buyer agents

Assume the commission is split equally between the listing agent and the buyer’s agent.

Commission per Agent = $30,000 / 2 = $15,000

Commission split with brokerage after the transaction: After this initial commission split agreement between buyer and seller agents of the total commission, each agent further divides their share of the commission with their respective brokerages. This real estate agent commission split with brokers will occur according to their contract terms. These brokerage splits can also vary widely and are influenced by factors such as the agent’s sales volume, experience, and negotiated terms with the brokerage.

Example calculation: Adding to the example calculation above and assuming the agent has a 70/30 split agreement with their brokerage:

Agent’s share: 70% Brokerage’s share: 30%

Step 1: Calculate agent earnings

Agent’s Earnings = Total Commission x Agent’s Share

Agent’s Earnings = $15,000 x 70% = $10,500

Step 2: Calculate brokerage earnings

Brokerage’s Earnings = Total Commission x Brokerage’s Share

Brokerage’s Earnings = $15,000 x 30% = $4,500

Side note: Dual agency can occur when a single agent represents the buyer and the seller in the same transaction. In such cases, the agent involved does not need to split the commission with another agent. This type of agency can increase the earnings for the agent, as they retain the full commission agreed upon in the listing agreement. However, you must disclose the dual agency to all parties. You also must have the explicit consent of both buyer and seller in writing, as it can raise concerns about conflicts of interest and the agent’s ability to negotiate fairly on behalf of both clients.

Use The Close’s commission split calculator below to quickly calculate your take home money!

Real estate agent commission splits determine how earnings from property transactions are divided between agents and their brokerages. These splits can vary significantly, reflecting different business models and individual agreements, and play a crucial role in shaping a real estate agent’s salary, financial success, and career satisfaction.

Each split model has benefits and challenges for real estate agents tailored to fit various experience levels, performance, and market conditions. Here are some common types of commission splits that agents encounter in the industry:

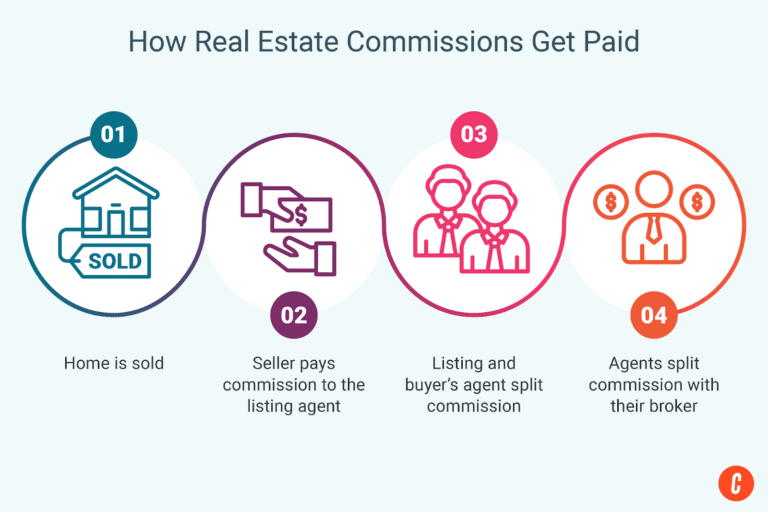

The seller typically pays the commission in sales transactions. This arrangement is agreed upon when the seller signs a contract with a real estate broker during the listing process. The agreement stipulates that a specific percentage of the sale price will be allocated to the real estate agent or broker as a commission. This commission is shared between the listing agent and the buyer’s agent according to the pre-established commission split.

Agents should understand that although the seller pays the commission, the funds come from the buyer’s purchase price. Thus, the buyer indirectly contributes to the commission through the overall price of the property. This understanding can influence how agents approach negotiations and explain the process to their clients.

The payment structure in rental transactions can vary. The landlord usually pays the commission, often equivalent to one month’s rent. However, if a landlord does not offer a commission or it is lower than usual, tenants may be required to pay directly for the agent’s services. This scenario is more common in competitive markets or high-end rentals where personalized service is a significant aspect of the rental process.

Once agents complete their real estate license and seek out a brokerage, they will receive an independent contractor agreement outlining their duties, responsibilities, and the specifics of their commission splits. As you excel in your career, you can negotiate this agreement to reflect your growing expertise, higher sales volumes, and enhanced market knowledge.

The real estate agent commission split with a broker significantly determines your income. Negotiating a favorable real estate agent commission split can substantially boost your earnings, allowing you to better reap the rewards of your hard work. Many agents will switch real estate brokerages if they feel their current terms do not adequately compensate them for their efforts.

Negotiating terms with your brokerage isn’t just about demanding more—it’s about demonstrating your value, understanding the business norms, and crafting a proposal that aligns your interests with your brokerage’s. Here are strategies to help you effectively negotiate better terms with your brokerage:

This commission rate varies significantly depending on geographical location and property type. For instance, in some cities, sellers might pay as little as 4% in realtor fees, while in others, the rates can climb to 7% for residential properties and even up to 10% for commercial real estate.

Location plays a critical role in determining commission rates in the real estate industry. Market conditions, average property values, and local competition all influence how much agents can charge for their services. Due to higher agent competition, commission rates might be lower in bustling urban centers.

In contrast, higher rates may prevail in rural areas due to fewer transactions and the need for more extensive marketing efforts. Understanding the nuances of your local market is essential for setting realistic commission expectations and negotiating effectively with clients and brokerages.

Understanding the typical commission rates in the real estate market is crucial for agents to know what is a good commission split in real estate. Then, they can set competitive and realistic expectations for their earnings. The average real estate commission in the United States is between 5% and 6% of the property’s sale price, typically split between the buyer’s agent and the listing agent.

| State | Average Commission Rates | State | Average Commission Rates |

|---|---|---|---|

| Alabama | 5.52% | Montana | 5.67% |

| Alaska | 4.99% | Nebraska | 5.71% |

| Arizona | 5.68% | Nevada | 5.08% |

| Arkansas | 5.72% | New Hampshire | 5.19% |

| California | 5.14% | New Jersey | 5.17% |

| Colorado | 5.58% | New Mexico | 5.83% |

| Connecticut | 5.38% | New York | 4.66% |

| DC | 5.3% | North Carolina | 5.56% |

| Delaware | 5.18% | North Dakota | 6.0% |

| Florida | 5.53% | Ohio | 5.81% |

| Georgia | 5.84% | Oklahoma | 5.63% |

| Hawaii | 5.39% | Oregon | 5.43% |

| Idaho | 5.69% | Pennsylvania | 5.44% |

| Illinois | 5.29% | Rhode Island | 4.86% |

| Indiana | 6.08% | South Carolina | 5.94% |

| Iowa | 6.15% | South Dakota | 6.0% |

| Kansas | 5.8% | Tennessee | 5.8% |

| Kentucky | 5.69% | Texas | 6.0% |

| Louisiana | 5.2% | Utah | 5.39% |

| Maine | 6.0% | Vermont | 6.0% |

| Maryland | 5.46% | Virginia | 5.58% |

| Massachusetts | 5.25% | Washington | 5.67% |

| Michigan | 5.93% | West Virginia | 5.44% |

| Minnesota | 5.53% | Wisconsin | 5.86% |

| Mississippi | 5.62% | Wyoming | 5.5% |

| Missouri | 5.79% | (Source: FastExpert) | |

The typical commission split between an agent and their broker can vary widely, but standard arrangements include 50/50, 60/40, and 70/30 splits. The specific split often depends on the agent’s experience, sales volume, and the brokerage’s policies. More experienced agents or those producing higher sales volumes may negotiate more favorable splits.

A 60/40 commission split means the agent receives 60% from a real estate transaction, while the broker gets 40%. This type of split compensates the agent for their direct work with clients and the brokerage for providing support, resources, and brand affiliation.

A real estate agent’s commission is split with a broker according to their agreed-upon contract. This split typically reflects the support and resources provided by the brokerage, such as office space, marketing, and administrative assistance. After a property sale is completed and the seller pays the commission, it is first received by the brokerage. The brokerage then disburses the agent’s share according to the negotiated split. This model aligns the interests of the agent and brokerage, encouraging both parties to contribute effectively to the sales process.

The real estate industry is about more than finding the right properties. It’s also about nailing the perfect commission split that makes every sale feel like a celebration! As you set off on this exciting journey, understanding and choosing your commission structure is as crucial as picking the right shoes for a marathon. With each transaction, your knowledge of commission splits isn’t just padding your wallet but also fueling your career growth and ensuring your efforts are recognized.

Remember, the art of negotiation is your secret weapon. Whether you’re the fresh face on the block or the seasoned and successful real estate pro everyone whispers about, negotiating your commission split is your chance to shine. Show off your value, and don’t settle for less than you deserve. Brokerages come in all shapes and sizes, each offering a smorgasbord of commission options. Align yourself with a good brokerage that’s as invested in your success as you are.